💱ALEX AMM

ALEX’s Automated Market Maker (AMM) — Short Version

ALEX’s core product is essentially a zero-coupon bond in conventional finance. A key benefit of this product is reduced uncertainty about a loan’s interest rate, resulting in better financial planning. Specifically, prior to entering a loan contract, borrowers and lenders secure the loan’s interest rate and tenor on ALEX.

1. Automated Market Making (AMM) Protocol

When designing AMM, ALEX believes in the following:

(i) AMMs are mathematically neat and reflect economic supply and demand. For example, price should increase when supply is low or when demand is high;

(ii) AMMs are a type of mean which remains constant during trading activities. This approach is adopted by popular platforms, such as Uniswap, which employ algorithmic means; and

(iii) AMM can be interpreted through the lens of modern finance theory. Doing so enables ALEX to grow and draw comparisons with conventional finance.

After extensive research, our beliefs led us to the AMM first proposed by YieldSpace. While we appreciate the mathematical beauty of their derivation, we adapt it in several ways with ALEX. For example, we replace a simple interest rate with a compounding interest rate. This change is in line with standard uses in financial pricing and modeling since the adoption of the Black-Scholes model. We also introduce a new capital efficiency scheme, as explained below.

In mathematical terms, our AMM can be expressed as:

x ¹⁻ ᵗ + y ¹⁻ ᵗ = L

where x, y, t, and L are, respectively, the balance of “Token”, the balance of “ayToken”, time to maturity, and a constant term when t is fixed. Interest rate r is defined as r = log*(y/x)*, i.e. natural logarithm of the ratio of balance between “ayToken” and “Token”, while the price of “ayToken” with respect to “Token” is (y/x)ᵗ.

Our design depicts an AMM in the form of a generalized mean. It makes economic sense because the shape of the curve is decreasing and convex. It incorporates time to maturity t, which is explicitly built-in to derive ayToken’s spot price.

2. Liquidity Providers (LP) and Capital Efficiency

LPs deposit both ayToken and Token in a pool to facilitate trading activities. LPs are typically ready to market-make on all possible scenarios of interest rate movements ranging from −∞ to +∞. However*,* part of the interest rates curve or movements will never be considered by market participants. One example of this occurs when the interest rate is negative. Although negative rates can be introduced in the fiat world by central bankers as a monetary policy tool, yield farmers in the crypto world are still longing everything to be positive. In ALEX, a positive rate refers to the spot price of ayToken not exceeding 1 and ayToken reserve being larger than Token.

Inspired by Uniswap v3, ALEX employs virtual tokens — part of the assets that will never be touched, hence they are not required to be held by LPs.

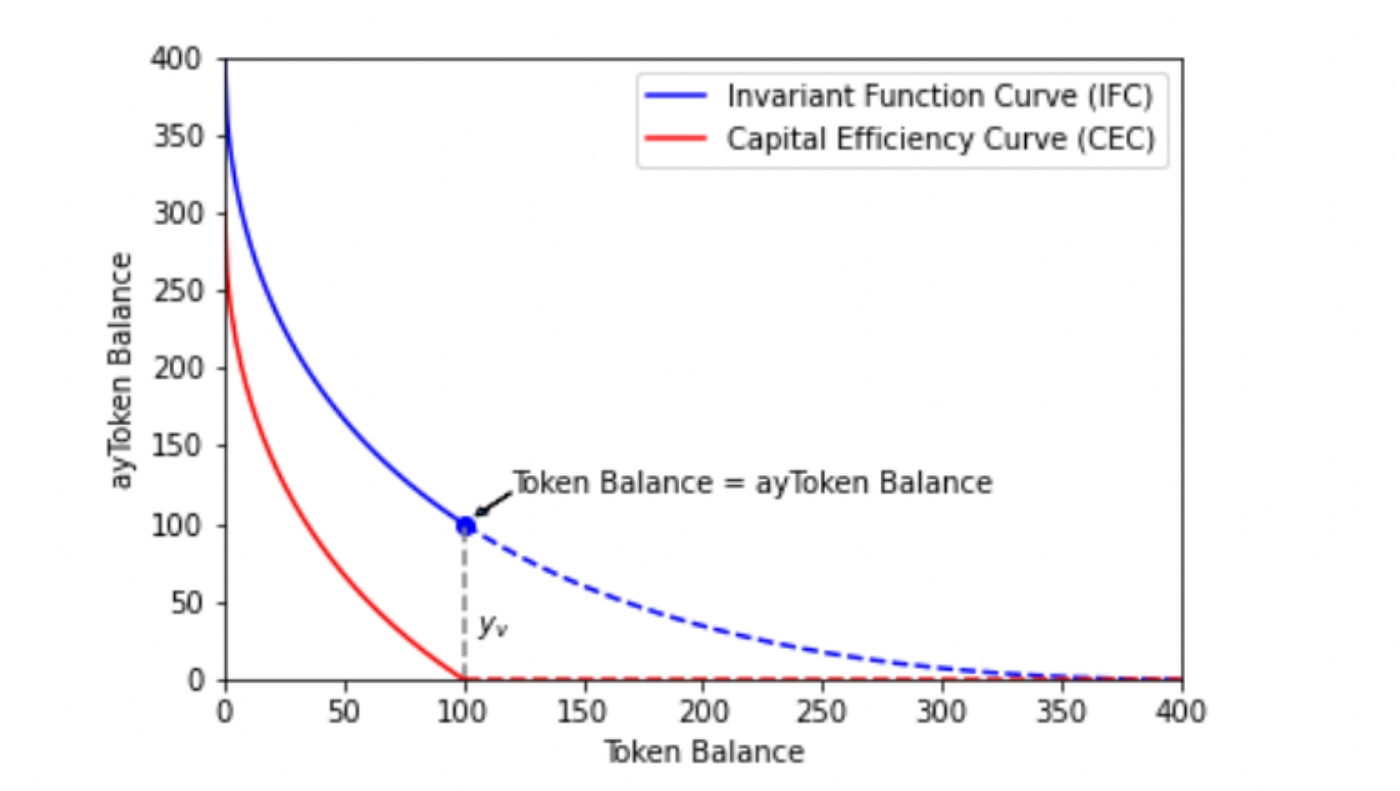

Figure 1: t = 0.5 and L = 20. Blue line (IFC) satisfies x ¹⁻ ᵗ + y ¹⁻ ᵗ = L, whereas red line (CEC) satisfies x ¹⁻ ᵗ + (y+yᵥ) ¹⁻ ᵗ = L. Virtual reserve yᵥ = 100.

Figure 1 illustrates an example of adopting virtual tokens in the event of a positive interest rate. The blue line is the standard AMM. The blue dot marks an equal balance of Token and ayToken of yᵥ, meaning there is no (or a 0%) interest rate. yᵥ is the boundary amount, as any amount lower than it will never be touched by an LP to avoid a negative rate, which is represented by the blue dashed line. Thus, yᵥ is the virtual token reserve. Effectively, LP is market-making on the red line, which shifts the blue line lower by yᵥ. When ayToken is depleted as shown by the red dashed line, trading activities are suspended.

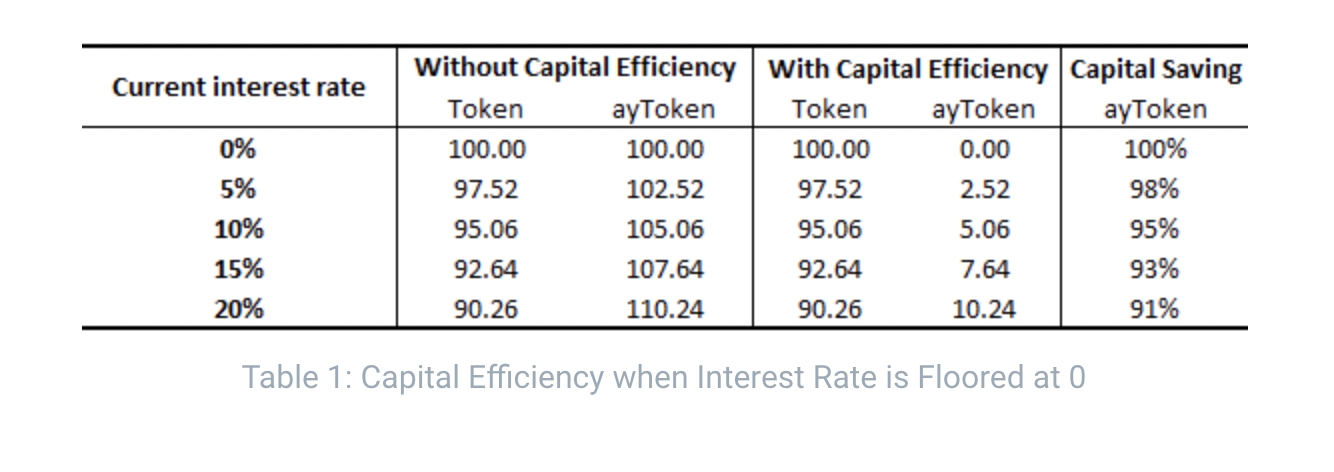

A numerical example provided in Table 1 shows capital efficiency with respect to various interest rates, assuming t = 0.5 and L = 20 for illustration’s sake. When the current interest rate r = 10%, LPs are required to deposit 95 Token and 105 ayToken according to standard AMM. However, if the interest rate is floored at 0%, LPs only need to contribute 5 ayToken, as the rest 100 ayToken would be virtual. This is a decent saving of more than 90%.

3. Yield Curve and Yield Farming

By expressing interest rate as pₜ =1/eʳᵗ, i.e. r = (-1/t) log pₜ, we can obtain a series of interest rates from trading pool prices with respect to various maturities based on which we are able to build a yield curve. The yield curve is the benchmark tool for modeling risk-free rates in conventional finance. The shape of the curve dictates the expectation of future interest rate paths, which helps market participants understand market behaviors and trends. Currently, we might be able to build a Bitcoin yield curve from Bitcoin futures listed on Chicago Mercantile Exchange (CME). However, not only is the exchange heavily regulated, its trading volume is skewed to the very short-dated front-end contracts lasting several months only. ALEX aims to offer futures contracts up to 1y when the platform goes live. Should markets mature, ALEX may extend to longer tenors.

Yield farmers can benefit from understanding the yield curve by purchasing ayToken whose tenor corresponds to high interest rates and selling ayToken whose tenor associates with low interest rates. This is a typical “carry” strategy.

Last but certainly not least, based on the development of a yield curve and the solid design work of our AMM, ALEX is able to provide more products. Specifically, ALEX will be able to offer derivatives, including options and structured products, building on and extending a large number of influential works of literature and applications in conventional finance.

Last updated

Was this helpful?